Parabolik Sar

Therefore many signals may be of poor quality because no significant trend is present.

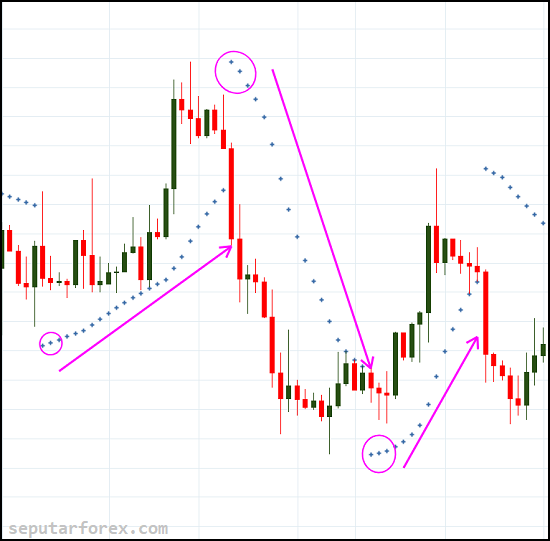

Parabolik sar. Welles wilder jr to find potential reversals in the market price direction of traded goods such as securities or currency exchanges such as forex. A trend indicator built by the now famous j. Welles wilder pada tahun 1978. The parabolic sar stop and reverse is the brainchild of j.

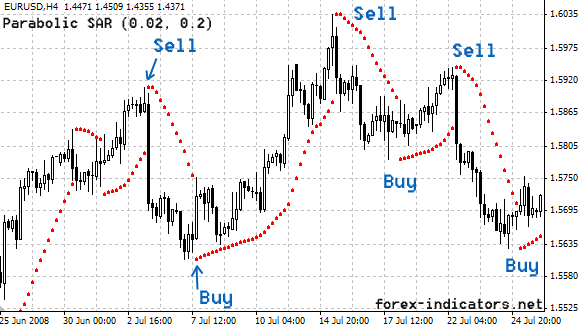

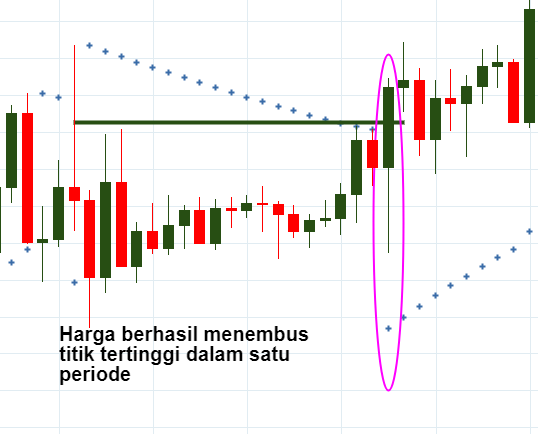

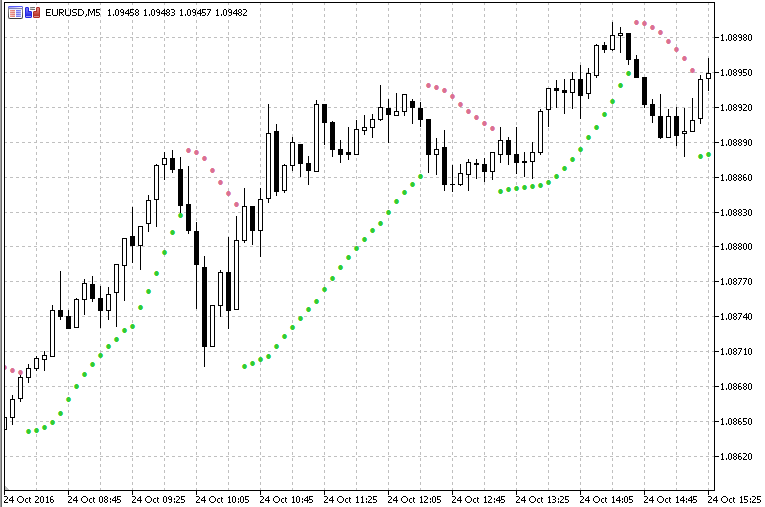

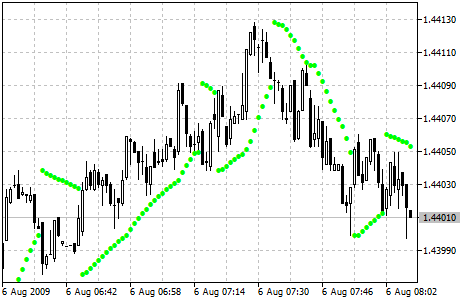

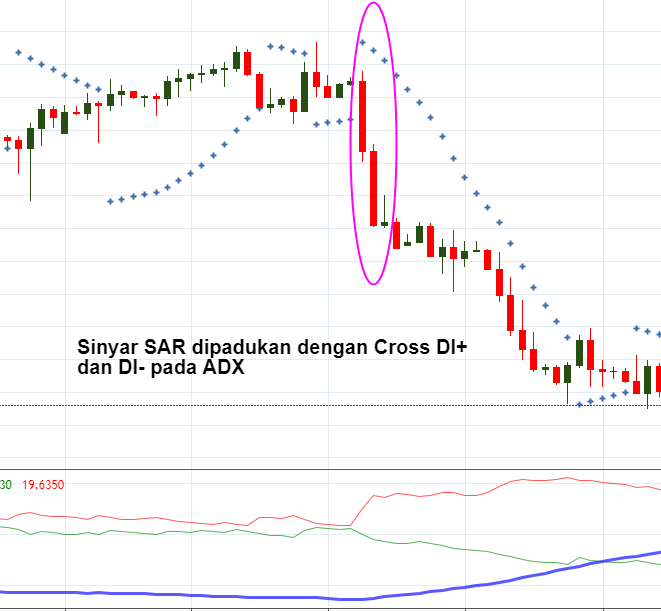

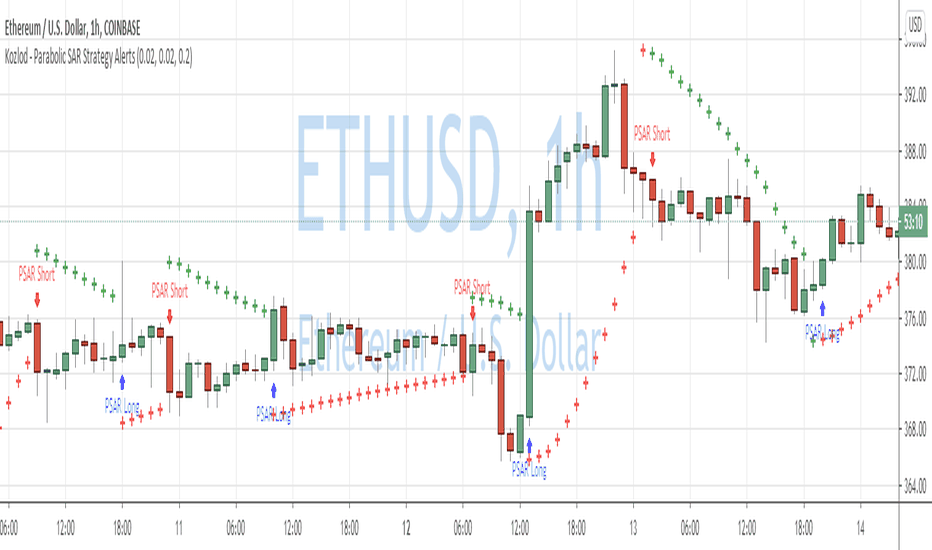

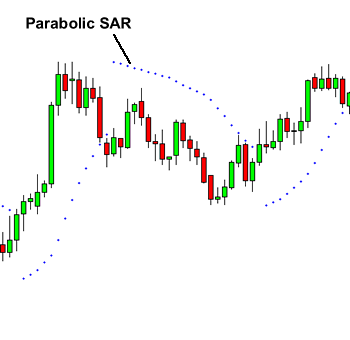

In this trading guide you ll learn how the parabolic sar through several trading strategies. The parabolic sar indicator is graphically shown on the chart of an asset as a series of dots placed either over or below the price depending on the asset s momentum. Welles wilder parabolic sar helps traders in a variety of ways the sar acronym stands for stop and reverse and the main parabolic sar strategy is to trail the stop loss in a rising or falling trend. Parabolic sar merupakan indikator yang penggunaannya simpel dan baik untuk dipakai dalam tren bullish atau bearish trend following yang kuat.

Welles wilder who also invented the rsi indicator it is a versatile trading indicator with unique properties. Parabolic sar strategy and how to use it in forex trading two powerful trading strategies colibritrader. The parabolic sar is a technical indicator developed by j. Welles wilder to determine the direction that an asset is moving.

The indicator is also referred to as a stop and reverse system which is abbreviated as sar. Indikator ini kurang cocok untuk pergerakan harga yang sideways. Penemunya adalah seorang teknikal analis terkenal bernama j. The parabolic sar is always on and constantly generating signals whether there is a quality trend or not.

It is a trend following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points.

/ParabolicSAR-5c54a06946e0fb00013fae11.png)